Equip Your Service: Bagley Risk Management Insights

Equip Your Service: Bagley Risk Management Insights

Blog Article

Exactly How Animals Danger Defense (LRP) Insurance Coverage Can Safeguard Your Animals Financial Investment

Animals Danger Protection (LRP) insurance coverage stands as a reliable guard against the uncertain nature of the market, offering a tactical technique to guarding your possessions. By delving into the details of LRP insurance and its multifaceted advantages, livestock manufacturers can strengthen their financial investments with a layer of security that goes beyond market changes.

Comprehending Animals Threat Security (LRP) Insurance Policy

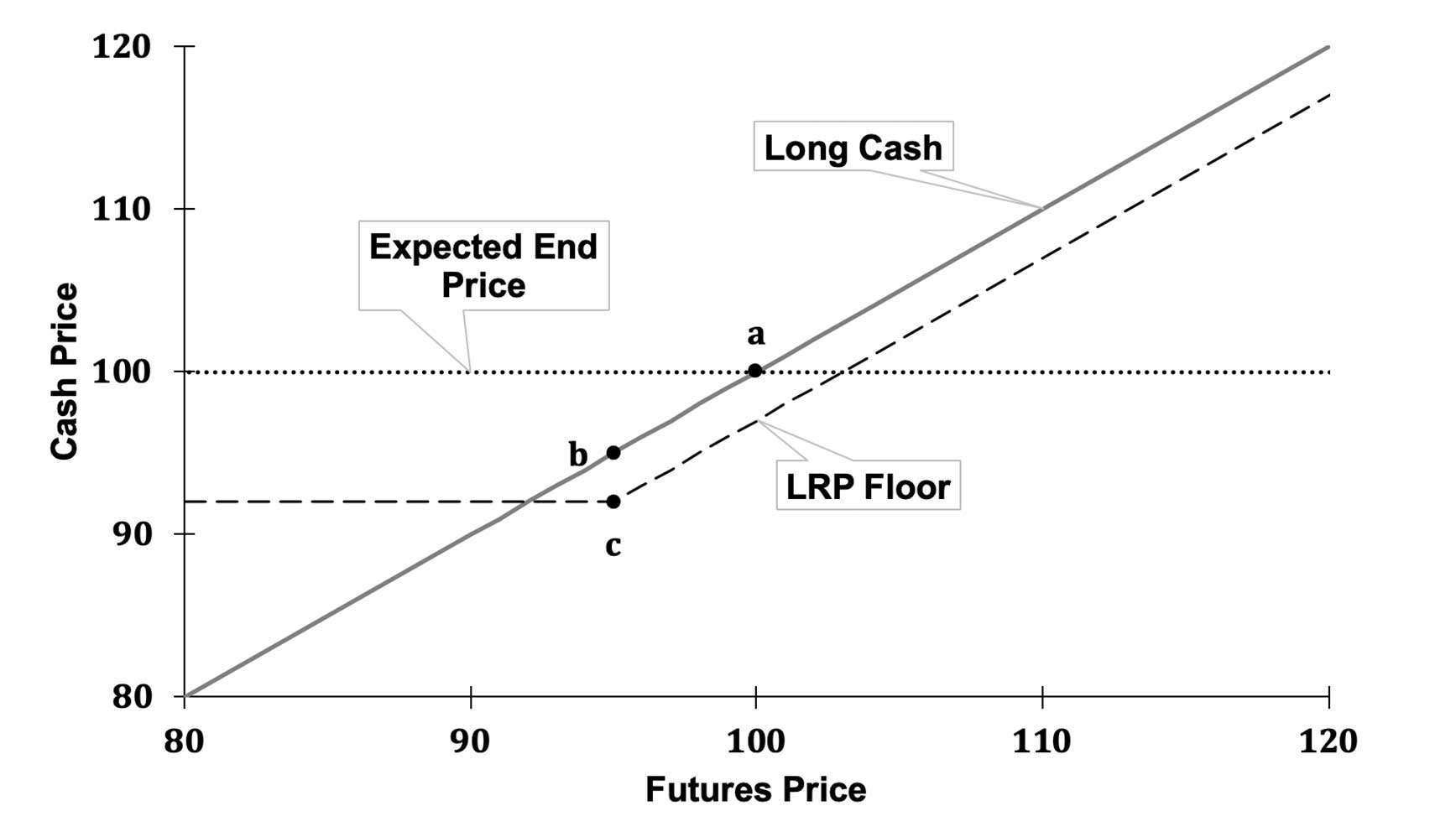

Understanding Livestock Threat Security (LRP) Insurance coverage is crucial for livestock manufacturers seeking to mitigate financial risks connected with cost fluctuations. LRP is a federally subsidized insurance policy product developed to protect manufacturers versus a decrease in market rates. By offering coverage for market price declines, LRP aids producers lock in a flooring rate for their animals, ensuring a minimal degree of earnings no matter of market fluctuations.

One secret facet of LRP is its versatility, allowing manufacturers to customize protection levels and plan lengths to fit their particular demands. Producers can select the number of head, weight range, insurance coverage cost, and insurance coverage duration that align with their manufacturing objectives and risk tolerance. Understanding these personalized choices is vital for manufacturers to properly manage their price threat exposure.

In Addition, LRP is offered for various animals kinds, including cattle, swine, and lamb, making it a flexible threat monitoring device for livestock producers throughout various industries. Bagley Risk Management. By acquainting themselves with the ins and outs of LRP, manufacturers can make educated decisions to safeguard their financial investments and ensure economic security in the face of market unpredictabilities

Benefits of LRP Insurance Coverage for Livestock Producers

Livestock producers leveraging Livestock Threat Protection (LRP) Insurance obtain a critical benefit in securing their investments from price volatility and securing a steady financial ground in the middle of market unpredictabilities. One vital advantage of LRP Insurance coverage is rate security. By establishing a flooring on the rate of their animals, producers can reduce the danger of significant financial losses in the event of market recessions. This enables them to prepare their spending plans better and make informed choices concerning their procedures without the consistent concern of price variations.

In Addition, LRP Insurance coverage gives producers with tranquility of mind. Overall, the benefits of LRP Insurance policy for livestock manufacturers are considerable, providing a beneficial device for handling danger and making certain economic protection in an uncertain market setting.

Just How LRP Insurance Mitigates Market Risks

Reducing market threats, Animals Threat Security (LRP) Insurance policy supplies livestock producers with a trusted shield versus cost volatility and economic uncertainties. By using security against unanticipated price declines, LRP Insurance coverage helps producers protect their investments and preserve monetary security despite market changes. This kind of insurance policy enables livestock producers to secure a price for their animals at the start of the policy duration, ensuring a minimum price level no matter of market changes.

Actions to Protect Your Livestock Investment With LRP

In the world of agricultural danger monitoring, implementing Animals Risk Defense (LRP) Insurance entails a calculated process to guard financial from this source investments against market fluctuations and unpredictabilities. To safeguard your livestock financial investment effectively with LRP, the primary step is to examine the particular threats your operation deals with, such as rate volatility or unforeseen weather events. Recognizing these dangers allows you to determine the coverage degree required to secure your financial investment effectively. Next off, it is vital to research and select a reliable insurance copyright that uses LRP policies customized to your livestock and business demands. When you have actually selected a supplier, meticulously review the policy terms, conditions, and insurance coverage limits to guarantee they align with your risk management goals. Additionally, on a regular basis monitoring market patterns and changing your coverage as required can aid maximize your protection versus possible losses. By complying with these steps vigilantly, you can boost the safety of your animals investment and browse market unpredictabilities with confidence.

Long-Term Financial Safety With LRP Insurance

Making sure withstanding economic stability with the use of Livestock Danger Protection (LRP) Insurance policy is a prudent lasting method for farming manufacturers. By integrating LRP Insurance policy right into their threat management plans, farmers can secure their livestock investments against unforeseen market variations and negative occasions that could endanger their financial wellness over time.

One key advantage of LRP Insurance for long-term financial protection is the satisfaction it uses. With a trusted insurance coverage in location, farmers can minimize the economic threats related to unstable market problems and unanticipated losses as a result of elements such as illness break outs or natural disasters - Bagley Risk Management. This stability permits producers to concentrate on the day-to-day operations of their animals business without constant fret about possible economic obstacles

In Addition, LRP Insurance offers an organized method to taking care of threat over the lengthy term. By setting details protection degrees and selecting appropriate endorsement durations, farmers can customize More Info their insurance coverage prepares to align with their economic objectives and risk tolerance, making sure a safe and sustainable future for their livestock operations. In conclusion, buying LRP Insurance policy is an aggressive strategy for agricultural producers to accomplish enduring financial protection and secure their livelihoods.

Verdict

To conclude, Livestock Risk Protection (LRP) Insurance coverage is an important device for animals producers to reduce market risks and safeguard their investments. By recognizing the advantages of LRP insurance policy and taking steps to implement it, manufacturers can attain long-term economic safety and security for their operations. LRP insurance policy provides a security net against rate variations and makes certain a degree of stability in an unpredictable market environment. It is a wise option for safeguarding animals financial investments.

Report this page